20 Game-Changing Finance Quotes from Warren Buffett: Unlock the Path to Riches!

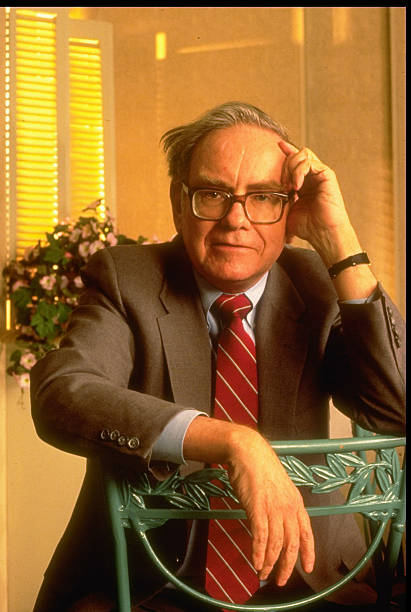

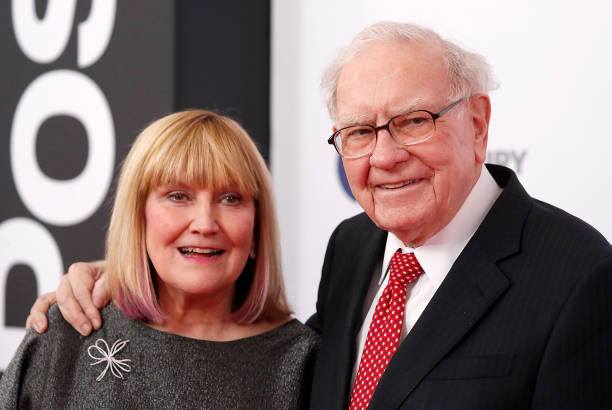

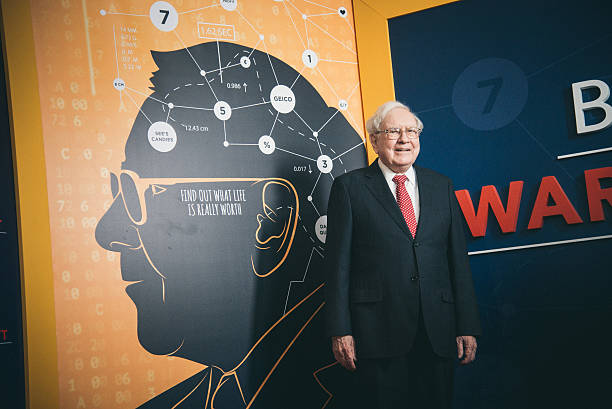

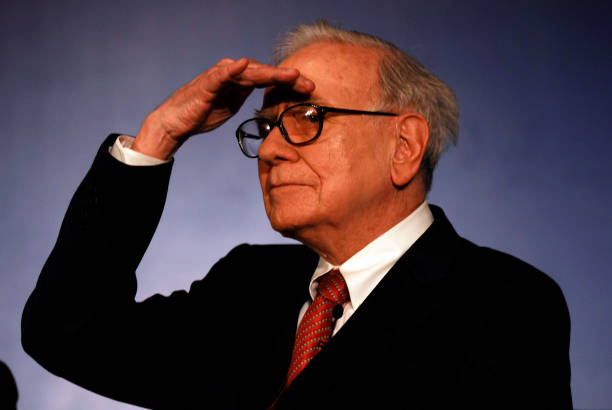

Born on August 30, 1930, in Omaha, Nebraska, Warren Edward Buffett is one of the most successful and revered investors of all time. Often dubbed the “Oracle of Omaha,” Buffett is known for his unique value-investing philosophy and his disciplined approach to the stock market.

Buffett has always maintained a frugal and down-to-earth lifestyle, a contrast to his immense wealth. He continues to live in the same house in Omaha that he purchased in the late 1950s and is known for his love of Cherry Coke and the products of companies he invests in, like Dairy Queen.

Below are some inspiration quotes from Warren Buffett on wealth, business, and success.

- Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1.

- I will tell you how to become rich. Close the doors. Be fearful when others are greedy. Be greedy when others are fearful.

- It takes 20 years to build a reputation and five minutes to ruin it. If you think about that, you’ll do things differently.

- Lose money for the firm, and I will be understanding. Lose a shred of reputation for the firm, and I will be ruthless.

- The stock market is a device for transferring money from the impatient to the patient.

- Price is what you pay. Value is what you get.

- The best investment you can make is in yourself.

- The difference between successful people and really successful people is that really successful people say no to almost everything.

- I always knew I was going to be rich. I don’t think I ever doubted it for a minute.

- People always ask me where they should go to work, and I always tell them to go to work for whom they admire the most.

- It’s not necessary to do extraordinary things to get extraordinary results.

- Wealth accumulation shows over the course of a lifetime. For most of us, the secret of getting rich is to get rich slowly.

- Investing is about minimizing risk to generate wealth over the long term, not generating short-term profits.

- The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.

- The stock market is designed to transfer money from the active to the patient.

- The best thing that happens to us is when a great company gets into temporary trouble… We want to buy them when they’re on the operating table.

- The business schools reward difficult complex behavior more than simple behavior, but simple behavior is more effective.

- You do things when the opportunities come along. I’ve had periods in my life when I’ve had a bundle of ideas come along, and I’ve had long dry spells. If I get an idea next week, I’ll do something. If not, I won’t do a damn thing.

- The most important investment you can make is in yourself.

- If you are in a poker game and after 20 minutes you don’t know who the patsy is, then you’re the patsy.

Warren Buffett’s investment success, combined with his wisdom shared through annual letters, interviews, and speeches, has made him a mentor to countless investors and business professionals worldwide. His legacy extends not only to the world of finance but also to philanthropy, where his contributions and principles will benefit global causes for years to come.

Want some more inspiration in a business perspective? Check out these quotes by Richard Branson here!