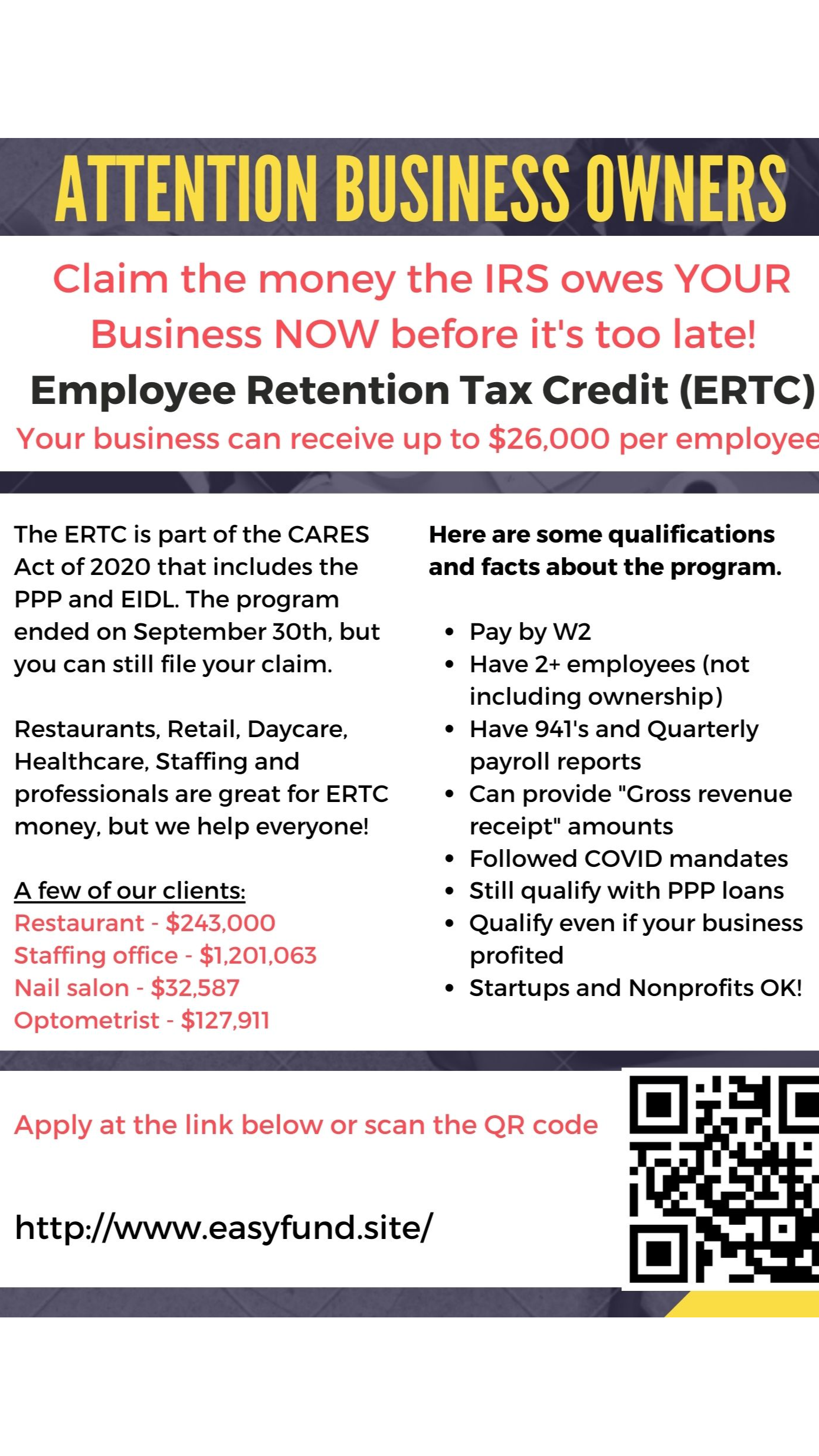

Get your ERC rebate, even if you weren’t eligible before! If you have 500 or fewer employees, you probably qualify – find out for free, and you might be able to claim up to $26,000 per employee in IRS refunds.

When the Employee Retention Tax Credit (ERTC) was first announced, it offered a few thousand dollars to business owners and had some really tough eligibility requirements.

But that was then, and this is now.

The ERTC has changed, a lot - and now all you really need to qualify is to have a small or medium-sized business that was open during the pandemic... because just about every open business was affected by it.

It also pays out a lot more than "a few thousand dollars" now. There are at least a few companies that claimed rebates in the millions!

Though you've probably heard of the ERTC program, I bet you haven't made a claim yet.

It’s estimated that 80% of small business owners may be eligible for rebates, which still have not been claimed - but it's time to change that. Fundwise uses a team of attorneys, CPAs, and financial experts to ensure you receive your maximum allowable tax refund, without having to worry about all the paperwork.

Want to know how much you may be eligible for? Visit http://www.easyfund.site and answer a few quick questions for a free estimate.

The ERTC program now includes almost any small or medium-sized American business, as long as it was affected by the pandemic in some way. You can use a free, no-obligation assessment on the Fundwise website to determine if you qualify and to get an estimate of your potential claim.

Any business that had 500 or fewer W-2 employees on the payroll during the pandemic can apply, including startups and non-profit organizations, such as churches, performing arts centres, and clinics. You can claim as much as $26,000 per employee, with no upper limit on funding, and no restrictions on how the money can be spent.

New businesses founded during the pandemic can also qualify, though they have a unique set of guidelines, and could be eligible for as much as $100,000. To apply as a Recovery Startup Business, you must have gross receipts of less than $1 million, and at least one employee who is not a family member or 50% owner.

The program has also been expanded to include businesses that have already received loans through the Paycheck Protection Program (PPP). However, unlike the PPP, rebates claimed through ERTC are not a loan, and never require repayment.

It's basically free money - with no strings attached. Technically it's a reimbursement for wages you already paid in 2020 and 2021, but what's important is that it's yours, with no restrictions, and you never have to give it back.

To claim a rebate, you only have to fill out a brief application on the Fundwise website, and the ERTC team will handle the calculations and complete the paperwork. Every business will receive a free, no-risk estimate of their available rebates before an application is completed, and a check in the mail from the IRS when their rebate is approved.

Though individual rebates will vary, the average small business has been claiming approximately $150,000, which never needs to be repaid. With no upper limit on funding, though, some businesses have claimed more than $2 million.

You can get a quick idea of your maximum potential claim by multiplying your number of W-2 employees by $26,000 - but that's only the highest potential amount. To get a real estimate, from a team of experts, visit Fundwise and start an application.

They'll make sure you get the rebate you deserve, with all the paperwork completed and filed correctly, so all you have to do is wait for your check in the mail.

Visit http://www.easyfund.site to get a free estimate, or to start your application.