Looking for guidance on your CARES Employee Retention Tax Credit application? Call Available Tax Credit at (813-760-4043) for a no-cost assessment on your eligibility today!

You don't need to weather the economic storm of the current pandemic alone - this company will provide you with complete guidance on all the steps to get a tax credit on your employee payroll from the IRS.

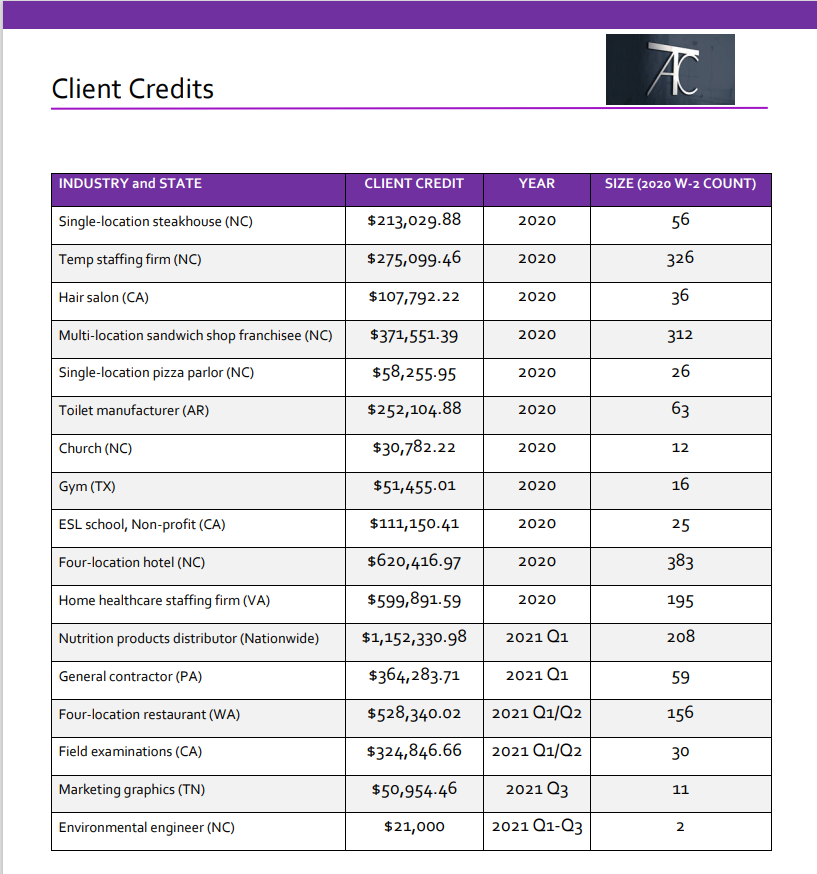

Available Tax Credit offers a service that will pre-qualify you and guide you through a successful application that gets you a tax credit of up to $26,000 for every employee.

Check it all out at https://availabletaxcredit.com

Available Tax Credit delivers access to funds through the Employee Retention Tax Credit (ERTC) program, which is open to US-based small business owners with 5 to 500 employees. You could be eligible for a tax credit even if you previously received a PPP loan.

The company partners with certified CPA experts who will use their in-depth knowledge of the ERTC program to pre-qualify your application and provide guidance on how much tax credit you are eligible for.

After submitting basic information about your business and W2 employees through the inquiry form on its website, the company completes your tax credit process in four simple steps.

Upon receiving an inquiry, Available Tax Credit will request that you provide relevant documents, including 941 returns, PPP loan documents, and payroll data.

In the next step, experts will review your application and calculate the highest possible amount of tax credit you will likely receive. A dedicated expert will help you file a 941-X adjusted employer’s federal tax return with the IRS based on the outcome of the pre-qualification stage. You will receive a check for your approved tax credit via mail once the IRS processes the application.

About The Company

Based in Lutz, Florida, Available Tax Credit provides accounting services for the ERTC program in partnership with certified CPA experts and in conjunction with Hit The Mark Media.

A satisfied client said, "Available Tax Credit did a great job walking us through everything we needed to move forward with our application. They made sure we got approved on every stage before any additional steps were taken. I highly recommend you reach out to them and see how much they can get for you."

Don't pass up an amazing opportunity! Call the team of experts at Available Tax Credit (813-760-4043) and get a no-cost assessment today.

Heard enough? Start your application today at https://availabletaxcredit.com