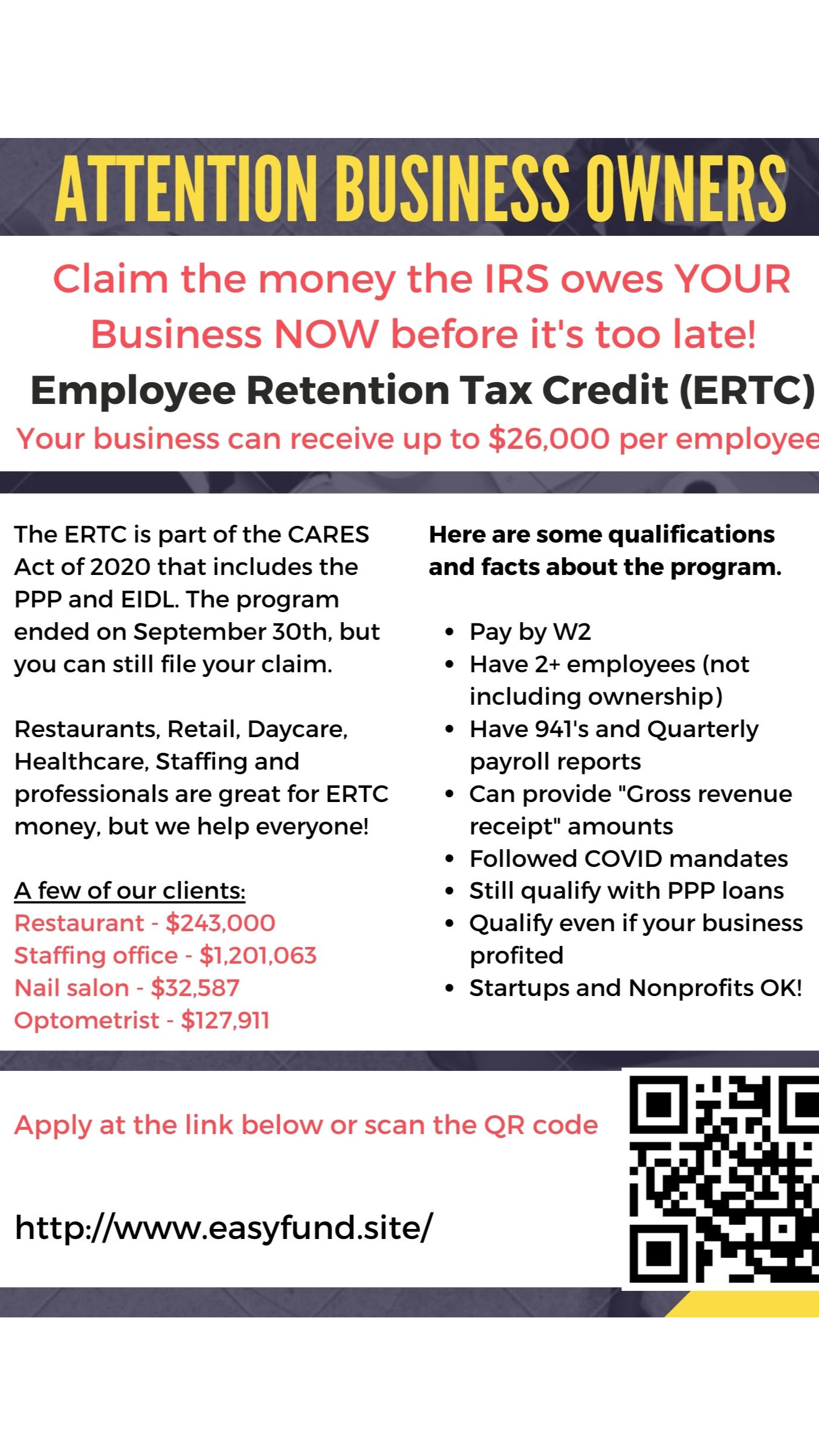

Did your business qualify for a PPP loan? Then it almost certainly qualifies for ERTC tax credits. You could be eligible for up to $26,000 per W-2 employee, with no strings attached.

Did you know that most small business owners are eligible for ERTC rebates - even if they don't know it?

The federal government has expanded the eligibility to include many small and medium-sized businesses that were originally disqualified. If you qualified for a PPP loan, you're almost certainly eligible, but unlike the PPP, these rebates are yours to keep with no repayment and no restrictions.

It's easier than you think to make a claim too. Fundwise ERTC experts can help you to maximize your rebates in no time, and you could be eligible for up to $26,000 per employee.

Visit http://www.easyfund.site to get a free estimate of your rebate, or to start an application.

The Employee Retention Tax Credit (ERTC) program was created in 2020, alongside the Paycheck Protection Program (PPP), but at the time most businesses weren't eligible. Since then, eligibility requirements have been expanded several times through amendments in the Consolidated Appropriations Act, the American Rescue Plan, and the Infrastructure, Investments, and Jobs Act.

To qualify for rebates under the new guidelines, you must have fewer than 500 full or part-time W-2 employees, and your business must have been affected by the pandemic. This can include suffering financial losses, or changes in the business due to government orders, such as lockdowns. Some businesses may also qualify if they were forced to operate at a reduced capacity because of remote working complications, limited occupancy regulations, or supply chain shortages.

The Fundwise team of attorneys, financial experts, and ERTC specialists can help you claim rebates for the entire duration of the program, or for individual fiscal quarters. Their team will assist you in determining which quarters you may be eligible for, which funds qualify for rebates, and the maximum amount you can claim.

Employers who are only eligible for individual fiscal quarters can claim up to $5,000 per employee for 2020, and up to $7,000 per employee, per quarter, for the first 3 quarters of 2021.

The updated application program includes no-cost, no-commitment rebate estimates, and a dedicated representative for each applicant. The program is open to any employer with fewer than 500 W-2 employees, including startups and non-profit organizations, regardless of if they have already received a loan through the Paycheck Protection Program (PPP).

Rebates claimed through the ERTC program are not a loan. They never require repayment and have no restrictions on how they can be spent.

To help business owners receive their rebates as soon as possible, Fundwise ERTC specialists aim to complete every claim quickly and accurately, with minimal involvement from the employer.

Fundwise ERTC experts have a 90% success rate in helping employers to claim their rebates, and you can get your free, no-risk funding estimate in just minutes.

Find out how much you can claim, get help from the experts to maximize your rebate, then sit back and wait for your check from the IRS - it's that easy.

Visit http://www.easyfund.site to get a free estimate right now.