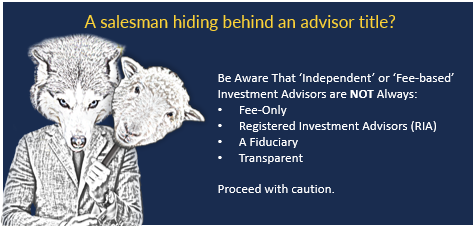

Make sure your advisors are neither wolves nor sheep. Sheep push products their managers want them to and wolves are out for their own benefit at investors’ expense. Easily learn what many advisors may not know or are not well educated about at your own pace, or just pick and choose among the video categories.

Saint-Laurent Associates is launching an unprecedented, easy to understand financial literacy basics course for the average person, WITH A REFRESHING TWIST. Unlike other financial informational courses, YOU WILL LEARN WHAT LEGACY, WALL STREET FIRMS AND SO-CALLED TALK-SHOW EXPERTS DO NOT WANT YOU TO KNOW, OR HAVE ARE NOT WILLING TO EDUCATE THEMSELVES ABOUT.

This is a limited time offer, at no cost or a small fee while still in the BETA phase. This much-needed information is what should be required material in high school and college. IT COVERS MATERIAL THAT MOST SO-CALLED ADVISORS AND FIDUCIARIES EITHER DO NOT KNOW OR WON'T TELL YOU.

It is not the job of a true advisor to filter out realistic options for prospects or client's. Yet, did you know many advisors are in breach of their fiduciary duty because the won't tell investors, or don't know about ALL the possible investment products or strategies available in the marketplace? It is an advisor fiduciary duty to disclose as much as possible and let the you, the investor, decide - even if it means the the advisor will not be compensated.....even if it means considering cryptocurrencies as a new, legitimate assets class.

My associates financial basics video's will give you the knowledge you need in order to have a better understanding your own financial affairs or hire the proper advisors. More importantly, this course explains what products and services are good or bad, without any sales pitch in a very unbiased manner. Make sure your advisors are neither wolves nor sheep. Sheep's push products their managers want them to and wolves are out for their own benefit at investors' expense. .

Saint Laurent Advisors (SLA), represents prospects and clients to find the proper solutions to suit each situation. This means you need to partner with advisors that will be ahead of the curve. As an independent RIA, I can be more proactive and nimble, allowing me to truly work in the investors best interests. Therefore, I search out cutting edge strategies or products and offer alternatives - some not yet understood by most firms but likely to become standard practice. Unlike traditional brokerage and highly advertised firms, SLA benefits as client's profit. I am proactive with suggestions and solutions. Contrary to what you may believe accountants and attorneys are not typically trained to be proactive and may not understand or expalin all the available options well enough. Beware the “generalist” advisors, who claims they are “fiduciaries” - there are varying degrees of “fiduciaries”. Know the types of “fiduciaries designations”, defined by the Department Of Labor and the IRS, and which best suits your objectives.

Don't take my word for it. See for yourself take our easy to understand and brief financial literacy course at your pace online go to:https://learn.financialliteracycourse.net/sign-up/saint-laurent-associates/?gid=1264&un2/iMVJnzTbg

Or access the course through our website ink: https://www.stlaurentpro.com/financial-solutions/hidden-cost-of-retirement/

Note: For best viewing open this link in Chrome, Explorer, Edge or iOS browsers.