The latest Crypto Info Wire report on ZenLedger will help you stay in control of your crypto taxes and eliminate the risk of an IRS audit!

With fines as high as $250,000, you really don't want to risk an IRS audit for messing up your crypto taxes. Check out this report for the super simple and accurate crypto tax calculation software you need!

Crypto Info Wire, a website specializing in high-quality cryptocurrency information, released a new report on ZenLedger. A tax calculation software with a variety of features, it is ideal if you're a cryptocurrency investor or CPA and you need an effective, accurate and reliable crypto tax tool.

Go to https://cryptoinfowire.com/zenledger for more info.

The latest announcement aims to respond to the growing interest in cryptocurrency tax calculation solutions. Since 2018 the IRS has invested significant resources in researching cryptocurrencies and begun paying particular attention to crypto transactions. This has made it essential for crypto owners to use an accurate tax calculation solution to avoid a tax audit.

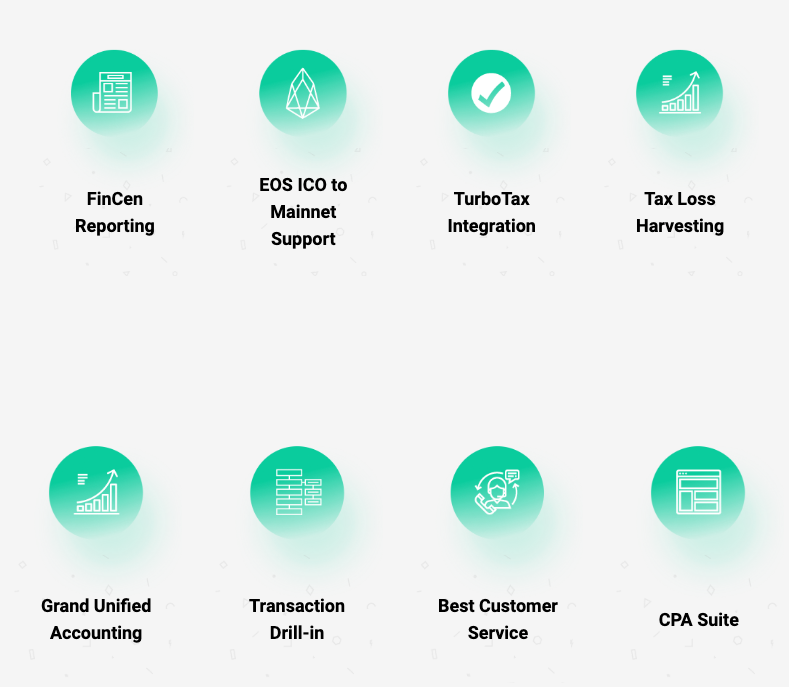

ZenLedger is a flexible software that allows you to calculate your cryptocurrency taxes easily and accurately. It is compatible with all major exchanges and supports over 300 coins, offering you a convenient way to calculate capital gains and losses.

According to the new report, ZenLedger is ideal for investors who want to stay in complete control of their crypto-related taxes while also taking full advantage of potential tax benefits.

“There’s no need to tangle with the IRS years down the road because you didn't know how to calculate the taxes owed on your crypto portfolio”, states the report. “Keep in mind, if you have losses, ZenLedger will show you those tax benefits that you don't want to miss out on. If you’re going to own bitcoin or other cryptocurrencies, you might as well do it right the first time.”

The crypto tax calculation tool is IRS-friendly and makes it easy to automatically produce a wide range of tax forms, including the IRS Form 8949. Its variety of automated reports also include Capital Gains, Income, Donation, Closing Reports and various others.

Crypto Info Wire explains that ZenLedger can also be a useful tool for CPAs looking for a centralized way to store the data of their clients and calculate their crypto taxes accurately.

With the latest report, Crypto Info Wire continues to expand its range of high-quality cryptocurrency resources.

Click on the link above for more info.