When families face selling a parent’s home for care costs, conventional wisdom says “always list with an agent.” But hidden costs, failed deals, and months of delays often make that advice dangerously expensive—especially in today’s Dallas market.

When adult children face the difficult decision of selling their parent's home during a care transition, the pressure to make the "right" financial choice can feel overwhelming. The conventional wisdom suggests listing with an agent always maximizes profit, but this assumption doesn't account for the hidden costs, extended timelines, and substantial risks that come with traditional sales—especially for older homes requiring immediate liquidation.

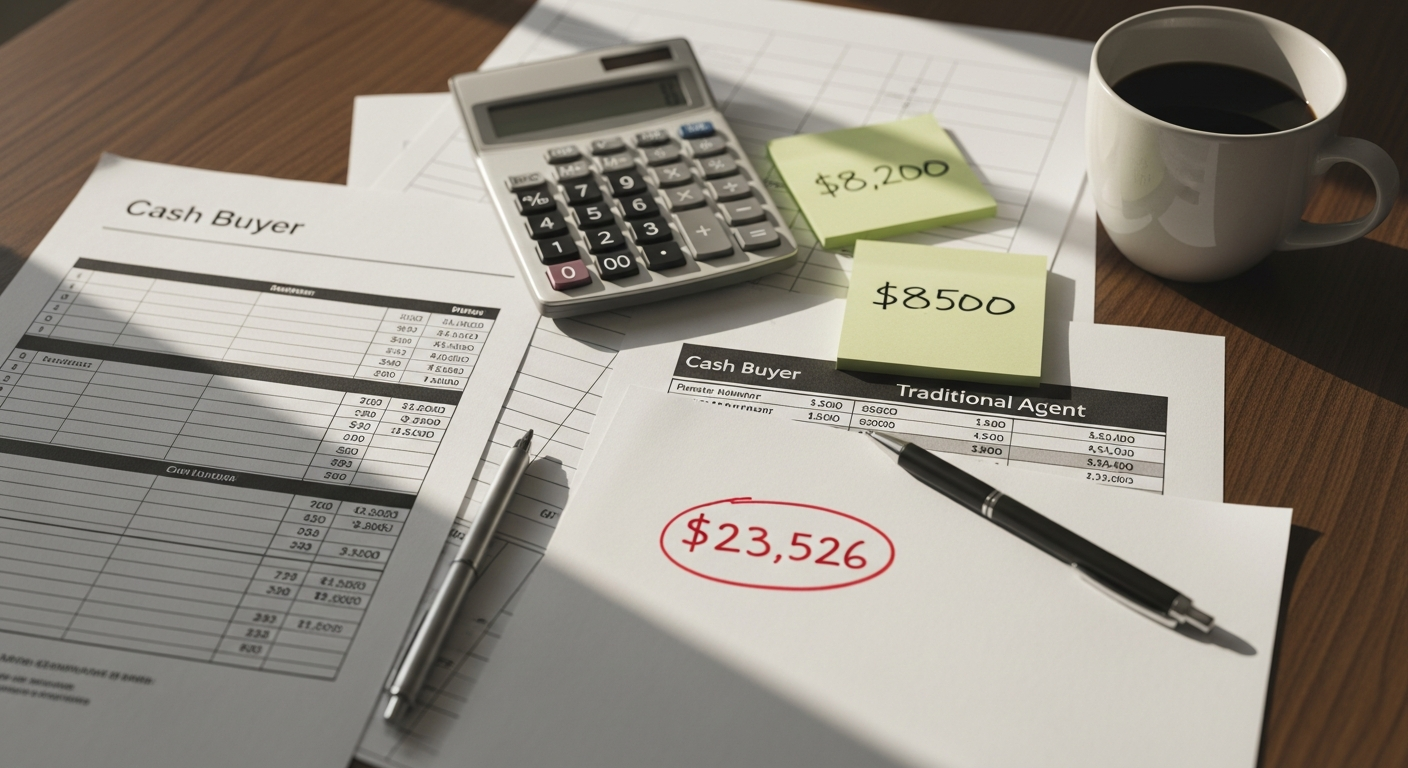

The sticker shock of a cash offer often focuses families on the wrong number. While cash buyers typically offer 10-20% below estimated market value, this discount tells only part of the financial story. Traditional sales carry substantial hidden costs that quickly erode the apparent advantage of a higher listing price.

Consider a $390,000 Dallas-area home—close to the current median. A cash buyer offering $331,500 (15% discount) eliminates the $22,815 agent commission (5.85% Texas average), $4,200 in three-month holding costs, and an estimated $7,500 in inspection-driven repair concessions. These avoided expenses significantly narrow the actual financial gap between the two approaches, often reducing what appears to be a $58,500 difference to approximately $23,500 in real net proceeds.

The calculation becomes even more favorable when factoring in the guaranteed nature of cash proceeds versus the uncertainty of traditional sales, where 20-25% of transactions fail after consuming weeks or months of holding costs.

Dallas-area homes average 56 days on the market before securing an accepted offer—slightly longer than the national average of 51 days. This market time, combined with the typical 44-day financing and closing period, creates a total transaction timeline averaging 100 days for traditional sales.

The extended timeline becomes particularly problematic for families managing senior care costs. Each month of delay accumulates unavoidable expenses while the family struggles to fund necessary care services. Properties requiring updates or repairs often experience even longer market times, with some listings stalling for 90-120 days despite price reductions.

Cash transactions eliminate market exposure entirely through direct offers and compress closing to 7-20 days by bypassing loan underwriting, appraisals, and lender documentation requirements. This 85-93 day time savings translates directly into preserved capital and reduced stress for families managing care transitions.

Texas homeowners face substantial monthly carrying costs during extended sale periods. Property taxes, insurance, and utilities for a typical Dallas home cost approximately $1,400 monthly—a figure that increases when including basic maintenance and security for vacant properties.

A 90-day traditional sale delay costs roughly $4,200 in holding expenses, while a six-month delay (common when initial listings fail) exceeds $8,400. These non-recoverable costs significantly impact net proceeds, making the guaranteed quick execution of cash sales increasingly valuable as delays extend.

Senior-owned homes often reflect decades of habitation with varying levels of recent maintenance. Properties showing visible aging—wood rot, outdated systems, or cosmetic neglect—face distinct disadvantages in today's buyer-favorable market where move-in readiness takes precedence over price discounts.

Modern buyers, particularly in the Dallas market where inventory has increased substantially in 2024, can afford to be selective. Properties requiring immediate attention to roofing, HVAC systems, or structural elements often struggle to attract offers regardless of pricing adjustments. This buyer preference shift means that the traditional strategy of "pricing to sell" no longer guarantees quick results for properties needing work.

The high concentration of available properties allows buyers to focus exclusively on move-in-ready options, leaving older homes to compete primarily on price—a competition that often results in extended market times and eventual price reductions that approach or exceed cash offer discounts.

Preparing an older home for optimal traditional sale requires significant capital investment and 6-12 month preparation timelines. Basic cosmetic improvements range from $1,500-$5,500, while major systems updates can exceed $100,000. Critical repairs common in senior-owned properties include:

These renovation costs, combined with 6-12 month preparation timelines, often make pre-sale improvements financially impractical for families needing immediate liquidation for care funding.

Understanding the complete cost structure of traditional sales reveals why the gross price advantage often diminishes significantly in net proceeds calculations. Multiple expense categories combine to create total selling costs ranging from 7.85% to 9.85% of the final sale price.

Texas real estate commissions typically average 5.85% total, split between listing agents (2.88%) and buyer agents (2.97%). On Dallas's current median home price of approximately $435,000, this commission totals $25,425—a substantial fixed cost that cash sales eliminate entirely.

This commission expense alone often approaches or exceeds the discount percentage offered by reputable cash buyers, making the commission savings a primary financial benefit rather than a minor consideration.

Inspection contingencies, included in 66% of mortgage-financed purchases, frequently result in repair credits or price concessions. Older properties typically face repair requests averaging $7,500, with major system issues potentially requiring $10,000+ in concessions.

These post-contract negotiations create additional uncertainty and potential deal failure points. Properties with multiple defect categories may face buyer withdrawal rates exceeding 25%, forcing sellers to restart the process with accumulated holding costs and market stigma from previous listing failures.

Appraisal gaps occur when professional valuations fall below agreed purchase prices, potentially derailing financing approvals. Older homes face elevated appraisal risk due to "effective age" calculations that consider condition alongside chronological age, plus functional obsolescence from outdated layouts or systems.

When appraisal gaps occur, sellers typically must reduce prices to match appraised values or risk transaction failure. Cash buyers eliminate this risk entirely by providing guaranteed purchase prices independent of third-party valuations.

Estate sales involving probate create additional complexity that dramatically extends traditional sale timelines while accumulating substantial carrying costs and administrative expenses throughout the extended process.

Texas probate typically requires 12-18 months for completion, with complex estates potentially extending beyond two years. The process involves multiple phases: 1-4 months for initial probate petition, 4-6 months for creditor notification and claims resolution, plus an additional 2-6 months specifically allocated for property sale and distribution.

Throughout this period, executors must maintain properties, pay ongoing expenses, and manage any necessary repairs while property values potentially fluctuate. Monthly holding costs of $1,400+ compound over 12-18 months, creating substantial erosion of estate value.

Out-of-state executors face additional complications through ancillary probate requirements when deceased owners held Texas property. This secondary legal process requires separate court proceedings, Texas-licensed attorneys, and coordination across multiple jurisdictions.

Ancillary probate adds months to years to estate settlement while substantially increasing legal fees and administrative complexity. Cash buyers often provide relief by acquiring properties subject to probate completion or closing immediately upon court authorization, transferring property management responsibility and risk.

Current Dallas-Fort Worth market dynamics create an environment where traditional sale challenges are amplified while cash transaction advantages become more pronounced for senior property transitions.

Cash purchases represent 32.8% of U.S. transactions in early 2025—indicating a strong investor market with established systems for rapid property acquisition and processing.

The high concentration of cash buyers means competitive offers and reliable closing capabilities, providing sellers with multiple options and reduced risk of individual buyer complications that can derail traditional transactions.

The 56-day average Days on Market in Dallas, combined with increased inventory levels, creates a challenging environment for properties requiring updates or repairs. Extended market times increase holding costs while reducing negotiation power as properties develop market stigma.

Properties that initially fail to attract offers often require progressive price reductions that can approach or exceed cash offer discounts, but without the certainty and speed benefits that make cash transactions valuable during care transitions.

The decision between cash and traditional sales ultimately depends on prioritizing either maximum gross proceeds or optimized net outcomes combined with transaction certainty and speed.

Cash sales provide optimal value when immediate care funding creates time pressure, when properties require substantial repairs that sellers cannot manage, or when out-of-state executors need to eliminate property management responsibilities during probate. The guaranteed net proceeds and elimination of transaction failure risk often outweigh the potential for higher gross sales prices that come with substantial costs, extended timelines, and uncertain outcomes.

Traditional listings remain appropriate only when properties require minimal repairs, sellers can comfortably manage 3-6 month timelines, and maximizing gross proceeds takes absolute priority over speed and certainty considerations.

For families managing senior care transitions, the financial pressure created by the dual burden of housing and care costs makes the immediate liquidity and risk elimination provided by cash sales often more valuable than pursuing potentially higher but uncertain future profits through traditional marketing approaches.

Families facing these difficult decisions can find expert guidance and support through Sage Senior Support, which specializes in helping families manage senior real estate transitions throughout the Dallas-Fort Worth area.