Following Hurricane Melissa, Jamaica waived Import Duty and GCT on over 50 essential goods through December 2025. Residents can import generators, building materials, and household supplies from US and Chinese retailers tax-free through shipping consolidators, eliminating costs that typically increase prices significantly

When Hurricane Melissa struck Jamaica in late October 2025, it left thousands of families facing damaged homes, power outages, and urgent needs for rebuilding supplies. In response, the Jamaica Customs Agency implemented an extended tax relief measure that's changing how residents access essential recovery items.

Understanding the Tax Waiver Program

From October 29 through December 31, 2025, Jamaicans can import over 50 categories of essential goods without paying Import Duty or General Consumption Tax (GCT). This policy addresses a critical challenge that Caribbean nations face during disaster recovery: accessing affordable supplies when local inventory runs low and prices surge due to increased demand.

For small island developing states like Jamaica, geographic isolation and limited local manufacturing create unique vulnerabilities during recovery periods. After major storms, essential items like generators, building materials, and emergency supplies often become scarce quickly, and traditional restocking can take weeks.

How Cross-Border Shopping Works for Relief Supplies

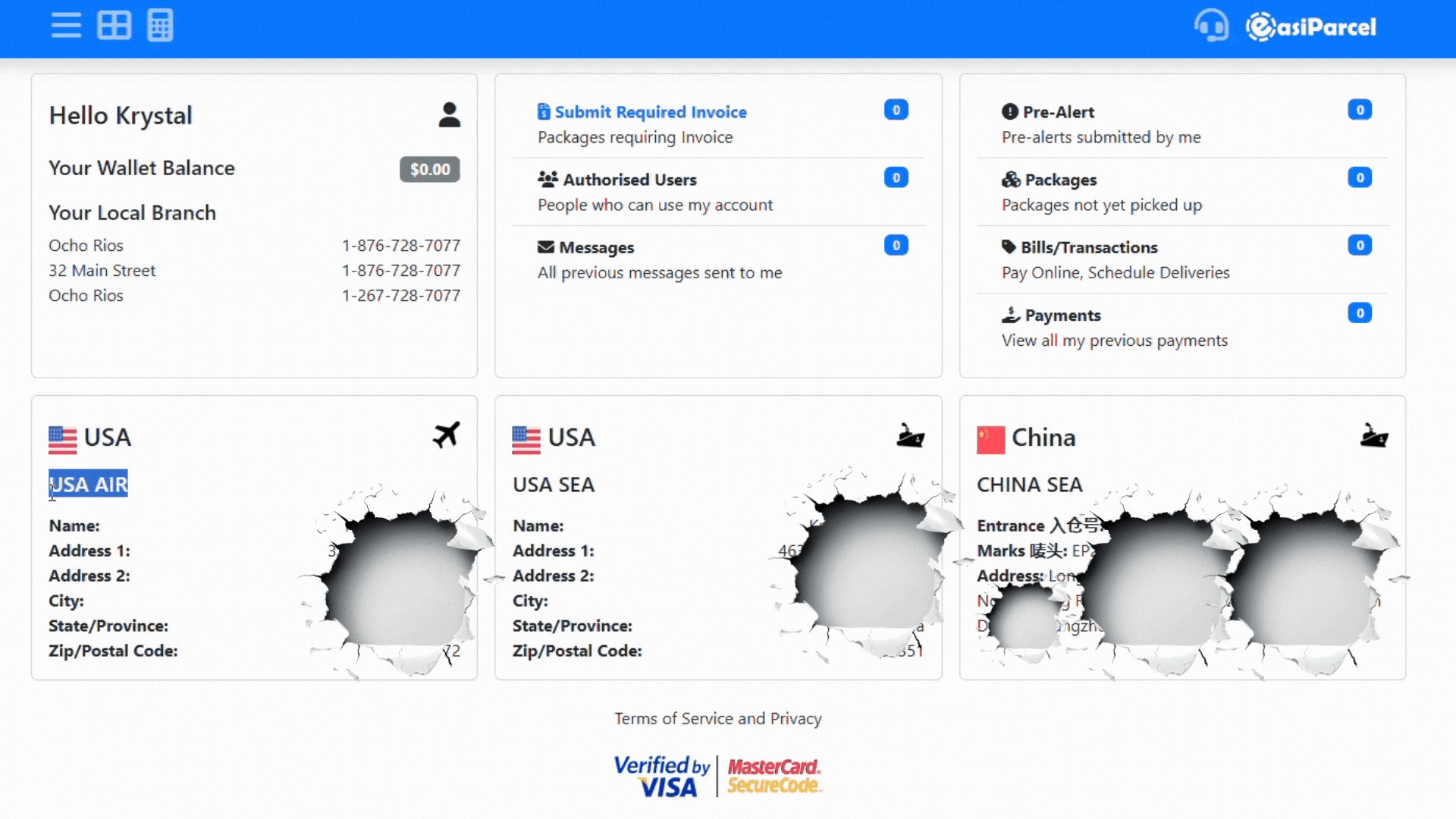

The tax waiver is designed to work with international shipping services that many Jamaicans are increasingly using for online shopping. The process involves signing up with a shipping consolidator that provides warehouse addresses in countries like the United States and China.

Shoppers can then purchase items from major retailers—Amazon, Walmart, and Target in the US, or Alibaba, Taobao, and AliExpress in China—and have them shipped to these warehouse addresses. The consolidator handles customs documentation and forwards packages to Jamaica, where they can be picked up at local collection points.

Several shipping consolidators operate in Jamaica with varying coverage areas. Services like EasiParcel, for instance, offer pickup locations in Spanish Town, Downtown Kingston, Half Way Tree, and Ocho Rios, while other providers may have different geographic coverage across the island.

During the waiver period, eligible relief items pass through customs without the typical substantial additional cost that import taxes normally add to international purchases—often increasing the final price by a third to half of the original purchase price.

Strategic Shopping: US vs. China Sources

The choice between US and Chinese suppliers often comes down to urgency versus cost-effectiveness.

US warehouses offer faster delivery—typically days to two weeks via air freight—making them ideal for urgent needs like generators or emergency supplies. Shoppers have access to familiar brands and English-language shopping platforms with transparent pricing.

China-based suppliers, meanwhile, offer significant cost savings, especially for bulk orders or construction materials. Sea freight takes longer (several weeks), but factory-direct pricing through platforms like Alibaba can substantially reduce costs for larger rebuilding projects. This option works well for community groups pooling resources or families making major reconstruction purchases.

Most shipping consolidators maintain warehouse facilities in both countries, giving customers strategic options based on their specific needs and timelines. Both routes qualify equally for tax-free entry, allowing residents to choose based purely on their timeline and budget.

What's Covered Under the Relief Program

The Jamaica Customs Agency's eligible items list is comprehensive, covering most hurricane recovery needs:

Power and lighting: Portable generators up to 5000 watts, batteries, mobile battery packs, solar flood lights, flashlights, and battery-operated radios—critical items since power restoration often takes weeks after major storms.

Shelter and bedding: Mattresses, linens, tarpaulins, tents, bed cots, and sleeping bags for families whose homes sustained damage or who need temporary shelter.

Construction and repair: Ply boards, nails, zinc roofing, and hand tools including drills, shovels, axes, hammers, and machetes for patching roofs, boarding windows, and clearing debris.

Water and storage: Bottled water, storage containers, and water purification kits (may require pre-approval) for areas where clean water access remains problematic.

Personal care and hygiene: Tissues, cleaning products, diapers, toiletries, first aid kits, over-the-counter medications, and sanitizers.

Kitchen and household essentials: Utensils, cookware, garbage bags, cleaning tools, fuel containers, and portable stoves for maintaining basic living standards.

Additional categories include rain gear and protective clothing, non-perishable food, school supplies, temporary sanitation systems, and insect repellents.

The Real Cost Savings

The financial impact is substantial. For typical hurricane recovery needs—a mid-sized generator, tarpaulin for roof protection, basic repair tools, and cleaning and first aid supplies—the tax savings can be significant.

Under normal circumstances, Import Duty and GCT together can add a third to half again of the purchase price. During the waiver period, families pay only for the products and shipping, eliminating this tax burden entirely. For families already strained by storm damage expenses and potential lost income, these savings make essential supplies accessible that might otherwise be financially out of reach.

Practical Considerations for Shoppers

Timing matters: Items must clear customs before December 31, 2025 to qualify. US air freight is faster, but China sea freight can take several weeks. Those shopping in late December should choose expedited options to ensure timely arrival.

Documentation: Clear receipts and descriptions help ensure smooth customs processing. Items should be identifiable as relief supplies within eligible categories.

Special approvals: Water purification kits and some repellents may require pre-approval or permits.

Generator limits: Only household generators up to 5000 watts qualify. Verify specifications before purchasing.

Consolidation savings: Making multiple smaller purchases and combining them into one shipment reduces per-item shipping costs—a service most consolidators offer as standard.

A New Model for Disaster Response

This initiative represents an evolution in Caribbean disaster response strategy. Traditional relief relies heavily on government stockpiles, international aid organizations, and charitable donations—crucial resources that can be slow to mobilize and sometimes poorly matched to specific local needs.

By empowering individuals to source their own relief supplies while removing tax barriers, this model gives families agency to address their unique situations. Someone knows whether they need a specific generator size, particular roofing materials, or specialized supplies for family members with disabilities or medical conditions.

The digital logistics infrastructure enabling this—international warehouses, consolidated shipping, customs expertise—already exists for normal commerce and can be rapidly repurposed for relief simply by adjusting policy and communications.

This is particularly valuable for small island developing states, where geographic isolation makes last-mile delivery of international aid expensive and complex. Leveraging established commercial shipping routes and local pickup points often achieves greater efficiency than purpose-built relief logistics.

Climate Change and Future Planning

As climate change increases the frequency and intensity of tropical storms, having scalable, efficient relief supply mechanisms becomes increasingly important for Caribbean nations. The success of Jamaica's extended tax waiver program may influence how other countries approach future disaster response.

Establishing tax waiver protocols paired with commercial logistics as standard elements of recovery planning could provide a template for faster, more cost-effective disaster response across the region.

Moving Forward

The extended December 31 deadline provides substantial time for Jamaican families to assess needs, research options, and make informed purchases of relief supplies. Whether sourcing a generator to restore power, materials to repair storm damage, or basic supplies to maintain health and hygiene during rebuilding, the tax waiver removes significant financial barriers.

For those navigating international shopping for the first time, shipping consolidators typically offer customer support to help with the process. The key is understanding what qualifies, choosing the right sourcing strategy based on urgency and budget, and ensuring purchases clear customs before the deadline.

Recovery from Hurricane Melissa will take time, but policy initiatives that remove financial and logistical barriers help ensure rebuilding happens as quickly and completely as possible for Jamaica's affected communities.