Don’t miss out on your tax credits for 2020 and 2021, even if you’ve already filed. This new report explains how to tell if you’re eligible, and how to amend your file to claim ERTC funds if you’ve already submitted.

Is your company eligible for ERTC funds?

What about if you already received money through the Paycheck Protection Program?

Is it too late to claim tax credits for 2020?

All your questions answered, and some helpful advice for maximizing your claims can be found in this new report from Scott Hall.

While most business owners have already filed their taxes for 2020, the new report from Scott Hall explains it is not too late to claim Employee Retention Tax Credits (ERTC) by updating your files. The report also includes information about changes made to eligibility requirements early in 2021.

To learn more about changes to the ERTC program, please watch this short video at https://vimeo.com/661297978

The newest round of changes to the ERTC means that many business owners who were not previously eligible to receive tax credits now are, even if they filed for the Paycheck Protection Program (PPP) in 2020. The Consolidated Appropriations Act, passed in 2021, included an amendment to the program that allows you to benefit from both the PPP and the ERTC programs.

Unlike the PPP, credits claimed through the ERTC program are not a government loan, and do not have to be paid back at any point. You can claim a percentage of wages paid to eligible employees from March of 2020 up to September 30, 2021.

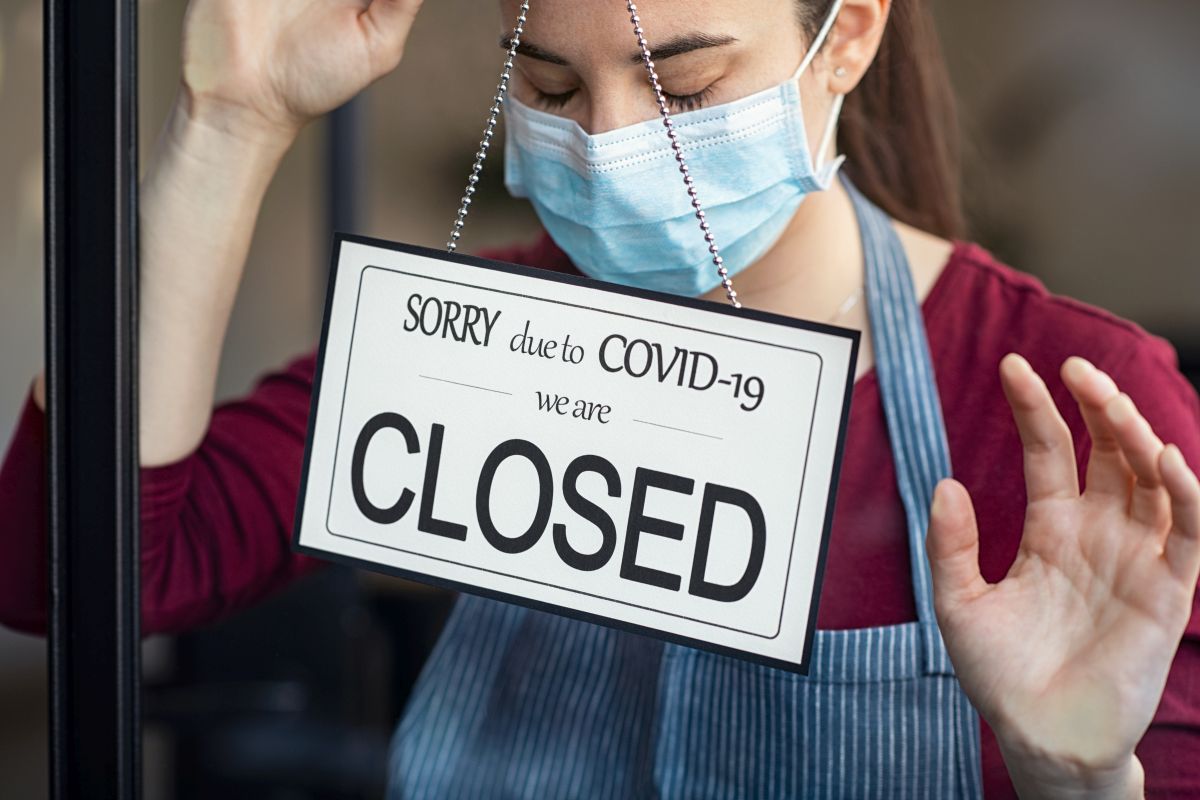

To be eligible for ERTC, you must have continued trade in 2020 or 2021, and suffered financial losses because of the pandemic. Losses may include time your business spent closed or partially suspended because of a government order or lockdown. You may also be eligible if you can show that your company suffered a significant loss in gross receipts.

According to the report, you may claim up to $28,000 in credits per eligible employee for 2021. To reach that number, you can claim up to 70% of an employee’s first $10,000 of wages, for $7,000 in credits, per quarter. To determine your eligibility, you can take a brief quiz at https://ertcquiz.com

Employers who have already filed their 2020 taxes may adjust their claims to include the ERTC program using a 941-X form. While you may file for the program yourself, the report suggests that an ERTC expert may make the process faster, and help you to maximize your credits.

To claim your credits through an ERTC expert, you will need to upload your 941 returns, PPP loan documents, and raw payroll data to a secure server. With that information, accountants specializing in ERTC claims can calculate your maximum allowable credits, and help you file with the IRS.

Even if you weren't eligible before, or received a PPP loan, you may be eligible now for tax credits. Talk to an ERTC specialist to determine if you can receive credits for 2020 and 2021 before it's too late.

Visit https://apnews.com/press-release/marketersmedia/business-small-business-ebad470d6d89b7dabe8d1735e261735b to read the full report.