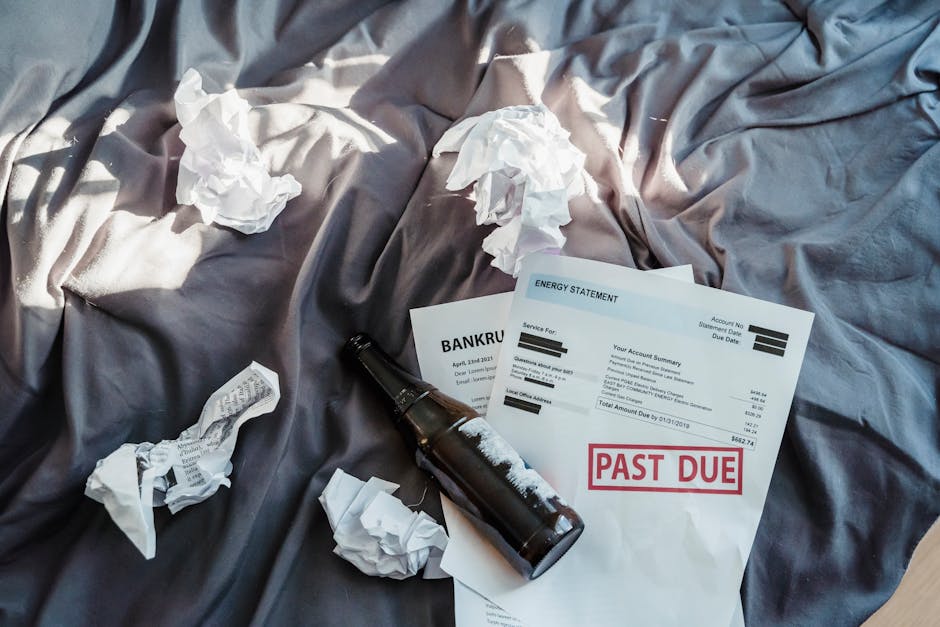

Think aggressive debt collection saves money? Think again. Each FDCPA violation can cost $500-$1,500 in penalties, and that’s just the beginning. Customer-focused strategies are quietly revolutionizing recovery rates while slashing hidden costs most agencies don’t even realize they’re paying.

Debt collection agencies and credit unions face mounting pressure to balance aggressive recovery tactics with customer retention. Traditional collection methods may deliver short-term results, but they often create costly long-term problems that erode profitability and damage brand reputation.

The shift toward customer-focused debt collection isn't just about ethics—it's about economics. Well-planned, empathetic strategies that prioritize customer relationships alongside recovery goals can increase ROI significantly.

Customer-oriented collections programs provide measurable benefits to financial institutions, including collecting more and higher payments, reducing operational costs, decreasing charge-offs, and strengthening long-term customer loyalty. This approach offers an opportunity to redefine the debt collection industry's reputation, shifting from aggressive to empathetic while driving increased receivables.

The traditional model of aggressive collection tactics creates a false economy. While harsh methods might seem to produce immediate results, they generate substantial hidden costs that compound over time. suggests that empathetic approaches consistently outperform aggressive tactics in both recovery rates and customer satisfaction metrics, as demonstrated by their own experience in the industry.

Aggressive collection practices create significant legal exposure that can devastate agency profitability. Compliance violations under the Fair Debt Collection Practices Act (FDCPA) and Telephone Consumer Protection Act (TCPA) can result in hefty fines, lawsuits, and reputational damage that far exceed the value of collected debts.

Low customer satisfaction from harsh collection tactics reduces collection rates, increases complaints, and adds to legal exposure. Each compliance violation under the FDCPA and TCPA carries potential penalties ranging from $500 to $1,500 per violation, and class action lawsuits can result in significantly higher penalties.

Aggressive collection methods often result in permanent customer loss, destroying valuable long-term revenue streams. When collection agencies prioritize short-term recovery over relationship preservation, they sacrifice future business opportunities that could generate significantly more value than the immediate debt collected.

Customer churn creates a cascading effect throughout the organization. Lost customers require expensive replacement efforts, increased marketing costs, and additional resources to rebuild trust in the marketplace. This cycle perpetually increases operational expenses while reducing overall profitability.

Paradoxically, aggressive collection tactics often produce lower recovery rates than customer-focused approaches. When debtors feel threatened or disrespected, they become less cooperative and more likely to avoid contact entirely, reducing the likelihood of successful resolution.

Poor recovery rates force agencies to allocate more resources per account, increasing operational costs significantly. Staff spend more time pursuing unresponsive debtors, technology costs rise due to increased contact attempts, and administrative expenses multiply as cases remain unresolved longer.

Offering flexible payment options makes it easier for debtors to repay their debts, demonstrating understanding and willingness to work with the debtor's financial situation. This approach recognizes that most people want to repay their debts but may need accommodations to do so successfully.

Flexible payment arrangements reduce the likelihood of complete default while maintaining positive relationships. When debtors feel respected and supported rather than pressured, they're more likely to engage constructively in repayment discussions and honor agreed-upon arrangements.

A customer-focused debt collection strategy is not just ethical but also effective, increasing recovery rates while maintaining positive customer relationships. Empathetic communication acknowledges the debtor's situation and works collaboratively toward mutually beneficial solutions.

This approach transforms the collection process from adversarial to collaborative, creating an environment where both parties work toward successful resolution. Preserved relationships often lead to voluntary compliance and faster resolution times, reducing overall collection costs.

Debt collection segmentation involves sorting clients based on their likelihood of paying. Clients with a good track record receive regular reminders, while those with medium risk benefit from proactive intervention steps tailored to their specific circumstances.

Understanding customer behavior and payment patterns through data-driven approaches enables efficient automated debt collection and strategic resource allocation. This segmentation allows agencies to customize their approach based on individual risk profiles, maximizing efficiency while minimizing unnecessary contact.

Automated reminders can significantly reduce late payments while requiring minimal human intervention. These systems can deliver personalized messages through multiple channels—SMS, email, and phone calls—ensuring debtors receive timely notifications before accounts become seriously delinquent.

Early intervention through automated systems prevents minor delays from turning into major collection challenges. The cost-effectiveness of automated reminders allows agencies to maintain consistent contact without overwhelming staff resources, creating sustainable prevention strategies that reduce overall collection workload.

Proactive communication strategies identify potential payment issues before they become serious problems. By monitoring payment patterns and reaching out to customers showing early warning signs, agencies can address issues while they remain manageable.

This preventive approach reduces the number of accounts requiring intensive collection efforts. When agencies intervene early with supportive communication, they often resolve issues quickly and maintain positive relationships that facilitate future cooperation.

A customer-centric approach in debt collection requires collaboration across different business areas, including customer acquisition, customer service, and data analytics. This integrated approach ensures consistent messaging and coordinated efforts that maximize effectiveness.

Cross-departmental collaboration eliminates conflicting communications and creates seamless customer experiences. When all departments work together with shared customer information and aligned objectives, resolution rates improve significantly while reducing operational redundancies.

Modern collection success requires sophisticated technology integration that combines payment processing, customer communications, and analytics capabilities. These platforms enable agencies to offer multiple payment options, track customer interactions, and analyze patterns that inform strategy improvements.

Technology integration allows for personalized customer experiences while maintaining operational efficiency. Advanced systems can automatically adjust communication timing, frequency, and tone based on individual customer preferences and response patterns, maximizing engagement while respecting boundaries.

Successful implementation requires staff training in customer-focused collection techniques. Training programs should emphasize empathetic communication, active listening skills, and solution-oriented problem-solving that prioritizes long-term relationship preservation.

Well-trained staff can handle difficult conversations while maintaining professionalism and respect. This training investment pays dividends through improved customer cooperation, higher resolution rates, and reduced staff turnover in what can be a challenging work environment.

Strong compliance protocols protect agencies from costly violations while ensuring customer rights are respected. These protocols should be embedded into all collection processes, from initial contact through final resolution, creating systematic protection against legal risks.

Compliance protocols should include regular auditing, staff education updates, and technology safeguards that prevent violations before they occur. Investment in robust compliance infrastructure ultimately reduces costs by preventing expensive legal consequences while supporting ethical collection practices.

The evidence overwhelmingly supports customer-focused debt collection as the most profitable long-term strategy. Organizations implementing empathetic approaches report higher recovery rates, reduced operational costs, and stronger client relationships that generate ongoing business value.

By implementing effective collection techniques, businesses maintain positive cash flow, reduce outstanding balances, and strengthen their financial stability while preserving valuable customer relationships. This approach creates sustainable competitive advantages that compound over time, generating superior returns compared to traditional aggressive methods.

The transition to customer-focused collections requires initial investment in technology, training, and process development, but the long-term savings and revenue benefits far exceed these upfront costs. Businesses that adopt this approach and work with experienced debt recovery professionals position themselves for sustained growth and profitability in an increasingly competitive marketplace.