When foundation problems hit your Dallas-Fort Worth home during a family care crisis, you’re facing more than repair costs—traditional sales can take 5-7 months while memory care can’t wait. But there’s a lesser-known timeline reality that changes everything.

Key Takeaways:

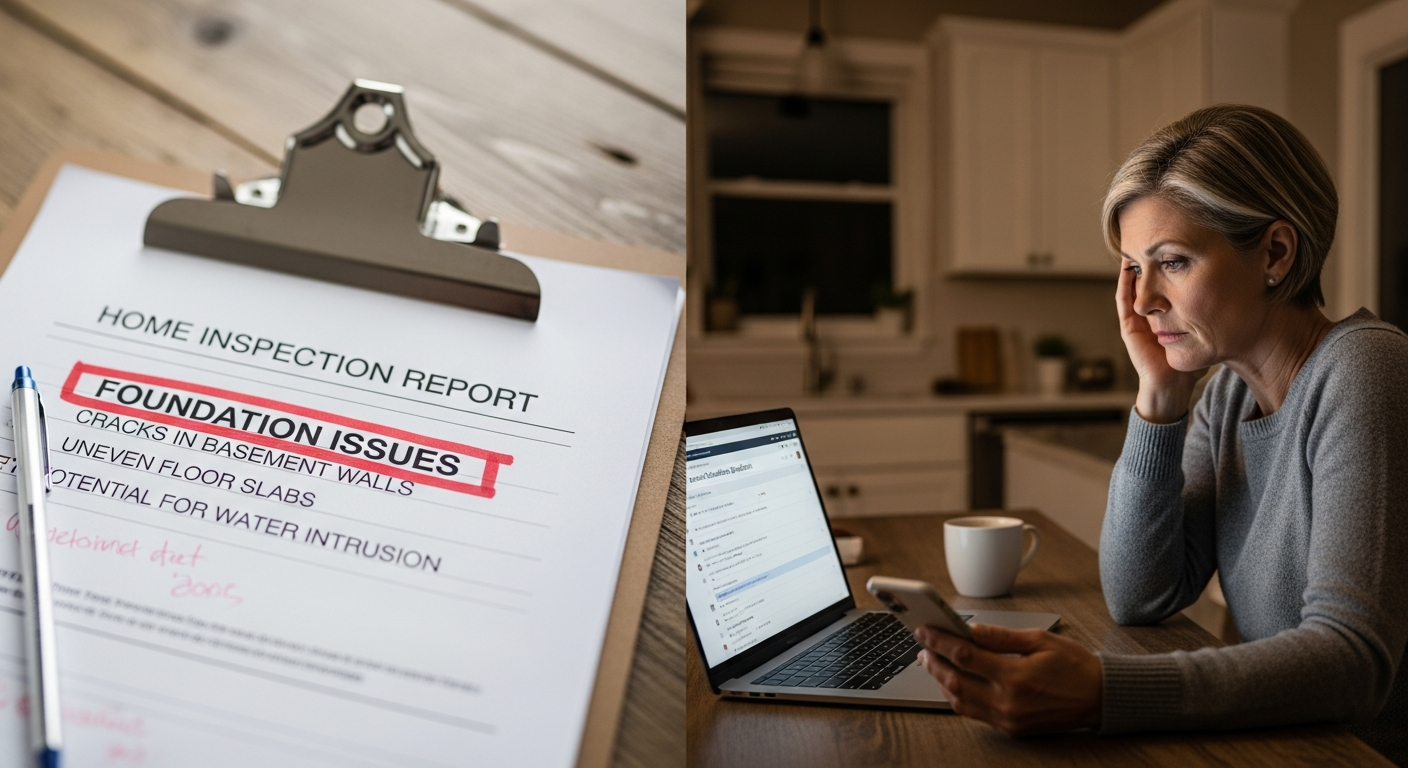

When the inspector's report lands with that dreaded phrase "foundation concerns," your first instinct might be panic. Your mother's memory care placement can't wait months while you navigate repairs and traditional sales. The facility needs deposits within days, not the 4-6 months a foundation-troubled home typically requires to sell traditionally.

Foundation problems in Dallas-Fort Worth aren't rare disasters or signs of neglect—they're geology. The expansive clay soil beneath North Texas swells when wet and shrinks when dry, creating a slow-motion roller coaster effect that impacts many homes built before modern foundation standards. This annual cycle of soil movement means foundation issues are simply a reality of DFW homeownership, not a reflection of poor maintenance.

You're not just panicking about the foundation. You're panicking because:

Here's what nobody's saying clearly: The foundation moved because it's in North Texas and that's what foundations do here. This isn't your fault. The issues existed before you got involved—you're just the one who got stuck dealing with them during a crisis.

The inspector isn't telling you something catastrophic when they note foundation movement. They're acknowledging that your parent's home exists in North Texas and has been subject to decades of natural soil forces. Understanding your realistic options when foundation issues complicate urgent care transitions becomes critical when time is your most valuable resource.

The real crisis isn't the foundation itself—it's what these issues do to your selling timeline when care facilities need immediate funding commitments.

Dallas-Fort Worth sits on a unique mix of clay and shale with high plasticity—meaning it dramatically changes volume based on moisture content. During spring's heavy rains, the clay swells upward, pushing foundations unevenly. Summer heat and drought cause the soil to shrink and pull away, allowing different foundation sections to settle at varying rates.

This isn't a one-time event. The cycle repeats annually, creating ongoing stress on foundation structures. Homes experience sticking doors in spring, settling cracks in fall, and gradual structural movement over decades. The soil composition makes this virtually inevitable rather than preventable through better maintenance.

The massive suburban expansion from 1970-1995 used construction techniques appropriate for that era but inadequate for long-term clay soil management. Standard slab foundations with minimal soil preparation were common before builders fully understood the expansive soil challenges.

These homes aren't poorly constructed—they're simply 30-50 years old and built before current drainage management and foundation engineering standards. Today's foundation practices include deeper soil preparation, enhanced drainage systems, and pier support designed specifically for clay soil conditions.

Understanding your specific foundation situation determines which selling path makes sense. Cosmetic/stable movement includes hairline cracks and minor settling that occurred years ago but has stabilized. These issues may only require small buyer credits of $1,000-$3,000 and don't typically kill traditional sales.

Active movement shows new cracks, doors that recently stopped working properly, and visible floor slopes. This requires structural engineer evaluation and typically $8,000-$25,000 in pier system repairs before traditional buyers will proceed. Significant structural concerns involve large cracks, severe slopes, and non-functional doors/windows, requiring $20,000-$50,000+ in major structural work.

Federal Housing Administration loans explicitly prohibit financing homes with readily observable foundation defects unless a structural engineer certifies the foundation is sound and required repairs are completed. This eliminates approximately 15-20% of potential buyers, particularly first-time buyers in the $200,000-$350,000 price range where many senior-owned homes fall.

Veterans Affairs loans enforce even stricter structural integrity requirements. VA financing won't approve if any structural concerns appear in the appraisal, and repairs must be completed before closing. Combined with FHA restrictions, foundation issues immediately eliminate 30-40% of potential buyers who rely on government-backed financing.

Even buyers with conventional financing face lender scrutiny when foundation concerns appear in appraisals. Many conventional loans require engineer certification, demand higher down payments, or refuse financing altogether. The buyer psychology around foundations creates additional challenges—most people hear "foundation problems" and immediately think "money pit," regardless of actual repair costs or home value.

Cash buyers become the primary market for foundation-troubled homes, not because the homes are worthless, but because financing complications eliminate most traditional purchasers.

Texas law requires sellers to complete a Seller's Disclosure Notice specifically addressing known structural issues, including foundation problems. This disclosure protects sellers legally but doesn't require repairs—homes can be sold as-is with full disclosure.

However, disclosure doesn't eliminate buyer concerns. Once foundation issues appear in writing, buyers typically request significant credits, demand repairs, or negotiate substantial price reductions to compensate for perceived risks and future maintenance concerns.

Foundation repair costs in Dallas-Fort Worth vary significantly based on severity and required work. Partial pier systems addressing active movement typically range from $8,000-$15,000, while full perimeter pier systems cost $18,000-$25,000. Major structural repairs can exceed $30,000 when combined with necessary drainage improvements.

These figures align with regional data showing average foundation repairs between $3,400-$15,000 depending on damage extent. However, the repair cost itself isn't the primary financial concern—it's the timeline and carrying costs during the repair and selling process.

Homes with disclosed foundation issues typically require 3-5 times longer to sell than comparable move-in-ready properties. The traditional path involves 2-3 months for repairs, followed by 2-4 months for marketing and closing—totaling 4-7 months from decision to funding.

During this extended timeline, families pay ongoing mortgage, insurance, utilities, and maintenance costs while simultaneously funding urgent care needs. Memory care costs averaging $6,500 monthly mean a 6-month selling process consumes $39,000 in care expenses before receiving home sale proceeds.

Homes with foundation histories may experience a reduction in value, potentially in the range of 10-20%, compared to similar properties without structural concerns. Even after completing repairs, buyers remain wary due to potential future issues and the stigma of previous problems.

Days on market also work against sellers. Extended listing periods signal underlying problems to potential buyers, creating additional negotiating leverage for purchasers and further reducing final sale prices.

This path works best for families with $20,000-$40,000 available for upfront repairs, timeline flexibility of 5-7 months, and stable parents not yet in crisis. The process involves structural engineer evaluation, foundation company selection, repair completion, re-inspection, and traditional listing.

While potentially yielding the highest gross proceeds, this option requires significant upfront capital, extended timeline management, and carries risk of deals falling through even after repairs. Success depends on having both financial resources and time flexibility.

As-is traditional listing suits families with 3-4 months flexibility who cannot fund repairs but want to attempt the traditional market. This approach typically yields 15-25% less than move-in-ready comparable sales but avoids upfront repair costs.

The risk involves potential buyers walking away after inspections, extended market time, and ultimate acceptance of cash buyer offers after months of traditional market attempts. This path often results in similar net proceeds as immediate cash sales but with significantly more time and stress.

Cash sales work best for urgent care situations, families with zero bandwidth for managing repairs, homes with multiple issues beyond foundation, and anyone prioritizing certainty over maximum price. Reputable cash buyers assess properties once, make firm offers based on after-repair value minus costs and margin, and close on seller-preferred timelines.

This option eliminates engineer evaluations, repair coordination, financing uncertainties, and inspection renegotiations. Sellers typically receive 70-77% of move-in-ready value but avoid all carrying costs, repair expenses, and timeline uncertainties.

David inherited his uncle's home with foundation issues, plumbing concerns, and roof damage. He tried listing traditionally with a family friend who was a real estate agent.

His real estate agent friend finally told him: "You should have just gone with the cash buyer in week one."

When David's parents later needed care, he contacted us. We closed in 22 days.

His takeaway: "The foundation issues weren't the problem—trying to navigate traditional sale with them was."

Cash buyers provide guaranteed funding without lending contingencies, appraisal requirements, or financing delays. This eliminates the most common deal-killing factors affecting foundation-troubled homes in traditional sales.

The certainty factor becomes crucial during care transitions. Once a reputable cash buyer commits to purchase, families can make firm commitments to care facilities without fearing last-minute financing failures or buyer walk-aways that characterize traditional foundation-troubled home sales.

When factoring care costs during extended traditional timelines, cash sales often net more actual money despite lower gross proceeds. A 6-month traditional sale timeline consuming $39,000 in memory care costs frequently eliminates any price advantage over immediate cash sales.

Home: 1,800 sq ft, built 1988, foundation + HVAC + plumbing issues. Move-in ready value: $340,000

PATH A - Repair First, Then List (6 months):

PATH B - Cash Buyer (1 month):

Cash buyer path nets you the same with being done with the home in 30 days, after accounting for care costs during the extended timeline.

The speed, certainty, and reduced stress of cash sales make them particularly attractive for adult children managing care transitions from distance or families overwhelmed by multiple crisis situations requiring immediate attention and resolution.

For families navigating foundation issues during urgent senior transitions, Sage Senior Support offers cash home buying services specifically designed for adult children managing care transitions in the Dallas-Fort Worth area.